Small Grant Application Pack

These Small Grant Application Guidelines take into consideration the importance of harnessing all available resources towards the implementation of activities aimed at meeting the objectives of this Grants programme.

The main objective of this Grants programme is to encourage non-for-profit sector to raise awareness on early childhood development and to nourish actions to its implementation.

Grant funding under these guidelines s shall be provided under the priority categories listed in the Areas of Intervention.

The above mentioned priorities are indicative and the list is not exhaustive. Innovative ideas are welcome with this call for proposals.

Award amounts

Proposals with budgets of up to £5,000 for first time applicants and £20,000 for recurring applicants and will be considered for award. However, value for money will be assessed as a part of the rating criteria.

Process

These guidelines under this section set out the rules for the submission, selection and implementation of grants projects financed under this grants programme.

HOW TO APPLY FOR A GRANT

Eligibility Criteria

There are eligibility criteria relating to:

- who may apply);

- projects for which a grant/contract may be awarded; and

- costs which may be taken into account in setting the amount of the grant/contract.

Fundamental principles

Grant applicants should consider the following fundamental principles in designing their grant proposals:

- an ethical approach to grant implementation;

- partnership with other stakeholders;

- project design with the potential for replication;

- sustainability of project.

Eligibility of applicants: who may apply?

- be a non-profit making organisation or NGO registered under Not-for-Profit Legal Entities Act;

- have been registered not less than two (2) years;

- be directly responsible for the preparation and management of the project, i.e. not acting as an intermediary;

- demonstrate prior experience in the area of conducting monitoring, analysis, report drafting, working with the social projects, advocacy, and the organisation’s potential to make useful contributions to the review process and follow up activities;

- have a bank account;

Eligible projects: which proposals may be funded?

Only proposals aimed at achieving the strategic objectives, priorities and results as indicated in these guidelines are eligible for funding

The following types of proposals are not eligible:

- proposals concerned only or mainly with individual sponsorships for participation in workshops, seminars, conferences, congresses;

- proposals concerned only or mainly with individual scholarships for studies or training courses;

- credit or loan schemes;

- debts and provisions for losses or debts;

- proposals which consist exclusively or primarily of capital expenditure e.g. land, buildings, equipment, vehicles, etc. These can be better dealt with through procurement;

- proposals which discriminate against individuals or groups of people on grounds of their gender, sexual orientation, religious beliefs, or lack of them, or their ethnic origin;

- scholarships, sponsorships and school fees;

- cash donations;

- political party and religious activities;

- proposals which provide funding for terrorist activities..

Number of applications per applicant

An applicant may submit only one proposal per year.

Please note that all activities financed by this Small Grants programme must be new interventions, i.e. not already existing, that would not be able to take place without the funding secured through the Grants award.

ELIGIBILITY OF THE COSTS

Which costs may be taken into consideration?

Only eligible costs can be taken into account. The categories of costs considered as eligible and non-eligible are indicated below. The budget is both a cost estimate and a ceiling for “eligible costs”. Note that the eligible costs must be based on real costs based on supporting documents. Costs that do not appear realistic may be rejected.

It is therefore in the applicant’s interest to provide a realistic and cost-effective budget.

Eligible direct costs

To be eligible, costs must be directly verifiable and traceable to the activities being implemented.

General provisions on eligible expenditures

- incurred during the duration of the action/eligibility period;

- directly connected to the activities of the project and indicated in the estimated budget;

- necessary for the implementation of the action;

- identifiable and verifiable, recorded in the accounting records of the beneficiary in accordance with the requirements of applicable tax and social legislation;

- reasonable, justified and cost efficient;

- actually incurred – actual payments made by the beneficiary and backed up by accounting documents.

Specific provisions on eligible expenditures

- Operational expenses: Operational expenses include those costs that have to be met for implementing activities for a project and they have a direct impact on the beneficiary community. Activities such as organizing a meeting, conducting a training, conference, seminar, workshop, running an awareness campaign, publications and dissemination, reporting, project monitoring and evaluation, and etc. involve certain expenses. They must be specifically incurred for the project, foreseen in the budget, clearly identifiable and not covered by any other heading of cost. The expenses must be exclusively linked to the project and reporting must be clear and precise. In linked to the organisation of project-related events, staff costs and travel costs must be budgeted and reported under Staff and Travel budget headings; reimbursement in cash should be avoided (e.g. speakers fees/interpretation services) and avoidance of double reimbursement of meals with per diems must be achieved. If the activities are to be subcontracted, the subcontracting rules must be applied.

- Travel expenses: The travel expenses must be directly linked to the project’s activities and made by persons taking part in the action (directly or contracted). All travels must be reported under this heading and in line with the beneficiary’s usual practices and systems. The most economical fare and method should be applied. In case of subsistence costs reimbursement of actual costs (accommodation, meals, and local travel) should be favoured. In case of per diems, they cannot exceed the scales approved by the local legislation.

- Staff expenses: Staff expenses refer to the costs towards paying salaries and consultancy fee to the staff of the project. Two sub-categories of staff are foreseen in the project: permanent working either full/part-time in the project or non-permanent: specifically recruited for the project. The staff cost must include the actual salary, the social charges and other statutory costs. The eligible staff cost is calculated whereas the daily/hourly gross cost is multiplied by no of days/hours worked for the project. For each staff working under the project, timesheets or an equivalent time registration system must be set in place by the organisation. The salary rates should not exceed the average ones corresponding to the beneficiary’s usual policy on remuneration. Staff expenses may not exceed more than 10% of the total eligible direct costs.

Eligible indirect costs (overheads)

The indirect costs incurred in carrying out the project may be eligible for flat-rate funding fixed at not more than 5% of the total eligible direct costs. These costs may be needed to employ, manage, accommodate and support directly the personnel working in the project; necessary to the project but not exclusively linked to it (office space, electricity, heating, management and administrative costs, phone, internet, office furniture…) and cannot include any costs already declared as eligible direct costs. Such amount may be reviewed in the context of the overall input-based budget submitted with the proposal. Any beneficiary receiving an operating grant from another project cannot request indirect costs in their final budget for an action grant covering the same period. It is possible that pre-selected proposals may be amended, at the recommendation of the Charity Committee, to exclude all indirect costs.

Contributions in kind

Contributions in kind are not considered actual expenditure and are not eligible costs for reimbursement.

Ineligible costs

The following costs are not eligible:

- debts and provisions for losses or debts;

- interest owed;

- salary top-ups and similar emoluments to government employees

- items already financed in another framework, i.e. existing capacity should not be included in the budget ;

- purchases of land or buildings;

- currency exchange losses;

- taxes, including VAT, unless the Beneficiary (or the Beneficiary’s partners) cannot reclaim them and the applicable regulations do not forbid coverage of taxes;

- credit to third parties.

APPLICATION PROCEDURE

Application process

The application process consists of 2 rounds.

The applicants initially submit a preliminary application form for the first round of evaluation. The application will be assessed by 2 individual evaluators. Applicants may expect an initial response from the DAF within 6 weeks of submitting their project outline.

After applicants have successfully passed through the first round of evaluation, they may be asked to submit a full Grant Application and Grant Budget. The DAF charity committee will not review full Grant Applications from applicants that have not successfully passed through the first round.

Application form

Applications must be submitted in accordance with the instructions on these guidelines. A preliminary application form is available at the bottom of this section.

All applications must be in English.

Due care must be taken to complete the application form. Any error or major discrepancy related in the application form (e.g. the amounts mentioned in the budget are inconsistent with those mentioned in the application form) may lead to rejection of the application.

Clarifications will only be requested if information provided is unclear, and prevents objective assessment of the proposal.

Hand-written applications will not be accepted.

Please note that only the application form and the completed annexes will be evaluated. It is therefore of utmost importance that these documents contain ALL relevant information concerning the project.

Where and how to send the application?

Both applications and their annexes are submitted via the online submission form on the website of Don Ash Charity Foundation.

The complete application form and annexes must be submitted in Word and Excel or PDF.

Applications sent by any other means (e.g. by fax or by mail) or delivered to other addresses will not be considered.

Incomplete applications will be rejected.

EVALUATION OF PROPOSALS

Evaluation and selection of applications

Applications will be examined and evaluated by the Charity committee evaluation team. All proposals submitted by applicants will be assessed according to the following steps and criteria:

If the examination of the application reveals that the proposed project does not meet the eligibility criteria, the application shall be rejected on this sole basis.

STEP 1: ELIGIBILITY ASSESSMENT

The following will be assessed:

- The proposal meets the rest of the eligibility criteria.

- The application form must include the provisional budget, duly filled. If any of the requested information in the preliminary application form is missing or is incorrect, the application may be rejected solely on that basis and the application will not be evaluated further

STEP 2: EVALUATION OF THE FULL APPLICATION

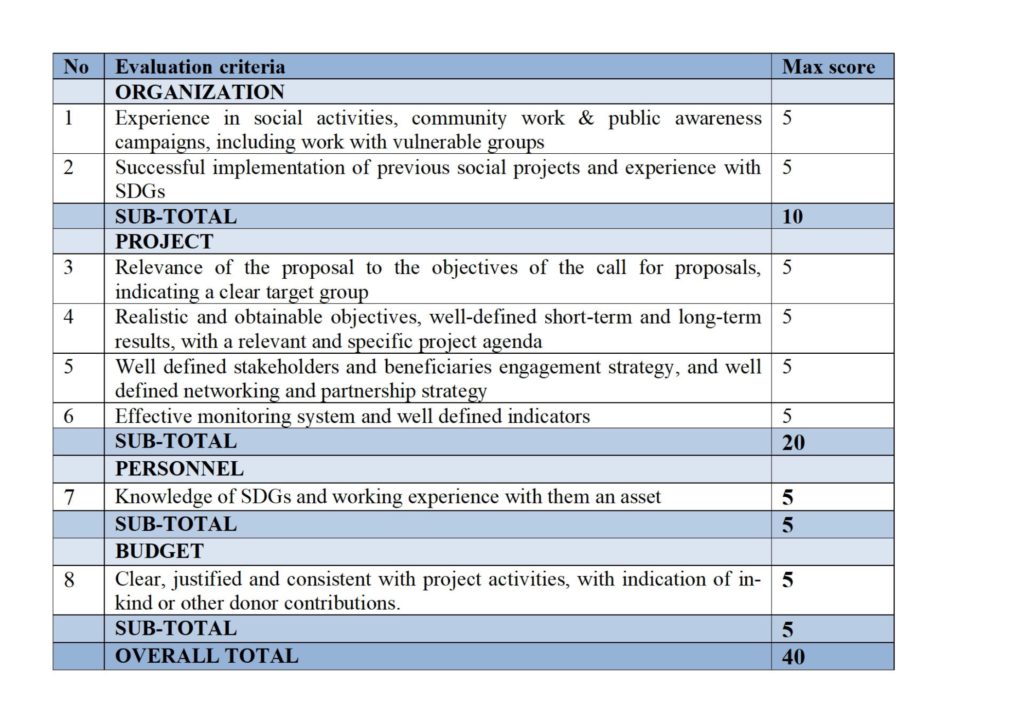

An evaluation of the quality of the applications, including the proposed budget, and of the capacity of the applicant and its stakeholders, will be carried out in accordance with the evaluation criteria set out in the Evaluation grid included below.

Scoring

The evaluation will be done by Charity Committee. Two evaluators from the Evaluation Committee will grade each application, then an average will be done of the results.

The evaluation criteria are divided into sections and subsections. Each subsection will be given a score between 1 and 5 in accordance with the following guidelines: whereas 1 = poorly meets the criteria and 5 = entirely meets the criteria. In addition, 0 = information not provided or irrelevant to criteria.

The substantive element of a project is a prerequisite section, all applicants who fail to obtain the minimum pass mark of 20 out of 40 in this category, will not be considered further, irrespective of the other scoring sections.

STEP 3: APPROVAL OF THE GRANTEE

The final approval of selected applications follows DAF’s procedures. The review considers whether the proposals put forward to them conform to the DAF rules and regulations, with special attention to the general principles of:

- fairness, transparency and integrity;

- effective competition;

- best value for money; and

- the interest of the community.

Notification of Decision

Applicants are informed in writing of DAF’s decision concerning their application.

SAMPLE EVALUATION GRID

DOCUMENTATION

Documents to be submitted on application

The following documents must be submitted as part of the preliminary application:

- application Form for Round 1 (Word or PDF Format);

The following documents must be submitted as part of the full application:

- application Form (Word or PDF Format);

- proposal Budget (Excel or DFG Format);

- registration certificate;

- financial statement for the past year; (or any other official supporting documentation showing annual income for the last one year)

- CV of the person to implement the project;

Further documentation may be required and these may be communicated to provisionally selected applicants in due course.

Documents may be checked for truthfulness and accuracy of representation through various means, including but not limited to internet searches, formally official confirmation from responsible offices, letters of recommendation, etc .

Documents to be signed between DAF and the Contractual Party

The following documents will be signed as part of the grant agreement between DAF and grant recipients:

- a grant agreement based on the standard DAF Grant agreement

- annex A – Full Application Form

- annex B – Budget breakdown

Reporting, monitoring and evaluation

It is the responsibility of grantees to monitor and report on the progress of implementation of their grants projects in accordance with the stipulation of the grant agreement and performance measures included in their proposal. Failure to monitor and report on progress of implementation could be a reason to blacklist an NGO for all future DAF grants.